PropNex Picks

|August 15,2025Too far, too small, too pricey - what do homebuyers want today?

Share this article:

Buying a new home can be a deeply personal matter, especially if one is purchasing the property for own stay. Apart from the property's price and location, prospective buyers also consider if the unit will fit their housing needs - whether the property is spacious enough to accommodate their family, if it has a good facing with great views, an efficient layout, and the range of facilities in the development.

Those who are buying an investment property may be less concerned about unit layout or if there are comprehensive facilities in the project. After all, they are looking to rent out the unit, not to live there. To this end, factors like affordable pricing, easy access to public transport system and amenities, as well as strong rentability are usually the key priorities for investors.

PropNex Research polled more than 1,100 respondents in Singapore between February and May 2025 to identify what truly sets buyers' hearts aflutter. Here are seven takeaways from the Homebuyer Sentiment and Preferences Survey 2025.

The survey found that about half of the respondents said they are either motivated or very motivated to enter the market to buy a residential property. This comes after home loan rates have fallen from previous highs - at over 4% p.a. in 2023 - to 2.2% to 2.6% p.a. in July 2025.

The 3-Month Compounded Singapore Overnight Rate Average (SORA) which banks use to price home loan packages has dropped steadily from the end of 2024, and stood at 1.87% p.a. as at 24 July 2025.

A more benign interest rate environment will help to support housing demand, particularly in the resale housing market where there is no Progressive Payment Scheme (PPS), which is a payment structure used when buying new launch properties that are still under construction. The PPS enables buyers to better manage their cashflow as repayments are made in instalments in tandem with the project reaching certain construction milestones. In contrast, buyers of resale homes pay a 25% downpayment and start their monthly repayment right away.

Over 7-in-10 of the respondents said they do not expect the prices of private homes and resale HDB flats to fall in the next 12 months. This follows the multi-year price growth in both segments of the market where private residential property prices climbed for eight years straight (2017-2024), while that of HDB resale flats increased consecutively for six years from 2019 to 2024.

However, the pace of price growth has started to ease, of late. In 1H 2025, the overall private home prices climbed by 1.3% compared with 2.3% in 1H 2024. In the HDB resale segment, prices rose by 2.5% in 1H 2025, slower than the 4.2% increase in the same period of 2024.

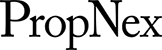

The slowing price growth may present buying opportunities. In particular, the narrowing price gap between new non-landed private homes in the Core Central Region (CCR) and Rest of Central Region (RCR) could be one to watch. Notably, the median unit price gap between the CCR and RCR shrank to its all-time low at 1.9% in 1H 2025 (see Chart 1), making new CCR private homes a good value proposition.

Chart 1: Median unit price ($PSF) of new non-landed private homes sold (ex. EC) by region and price gap (%)

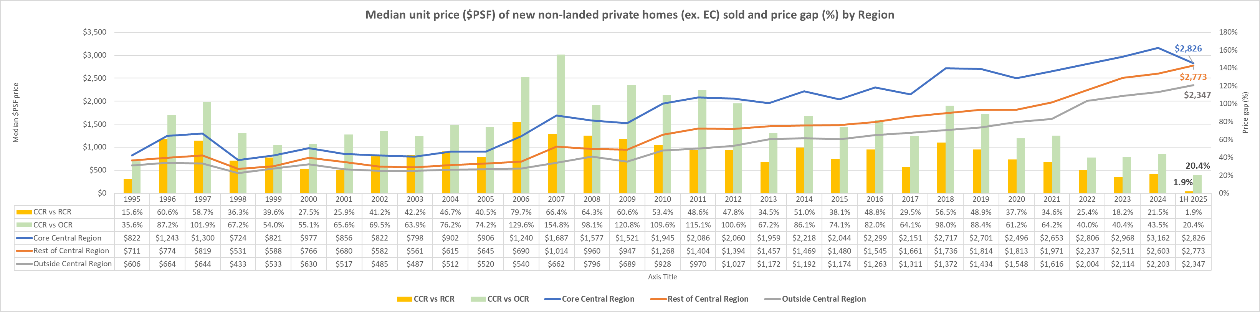

About 41% of those polled said they intend to look for a new home in the next six months, or are already actively house hunting (see Chart 2). Meanwhile, another 29% of the respondents are not planning to relocate, but may be on the look-out for an investment property. Collectively, this means that up to 70% of the respondents may be exploring options in residential property market, and this could be timely since many new condo launches are expected in the second half of 2025.

Chart 2: Housing plans of respondents

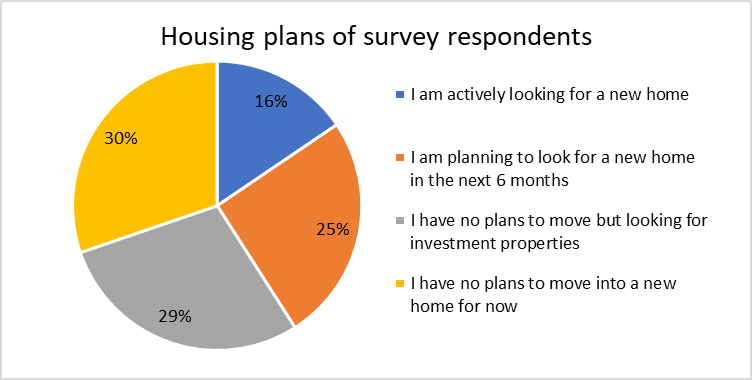

The survey found that private housing aspirations remain strong, with around 80% of the respondents (see Table 1) citing either a new launch or resale private condo or executive condo (EC) as their preferred property type. Of note, about 12% of those polled prefer HDB resale flats, higher than the 8% proportion in 2023. The slightly higher proportion could be due to the perception of being priced out of the private housing market, amid elevated home prices.

Table 1: Preferred property types cited by respondents (2023 vs 2025)

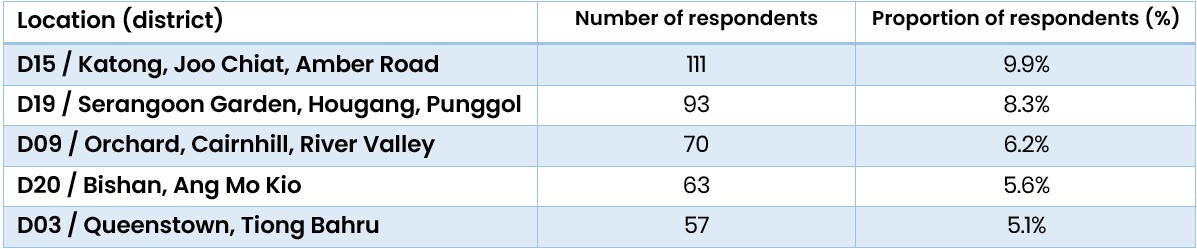

Among respondents who cited a preferred location, the most popular area was District 15 (Katong, Joo Chiat, Amber Road), followed by District 19 and District 9 (see Table 2). To this end, several major project-launches in D15 have done well. For instance, Emerald of Katong, Tembusu Grand, and freehold development The Continuum in D15 in the RCR have sold a healthy 88.5% of the combined 2,300 units as at end-June 2025, since they were launched in the 2023/24 period.

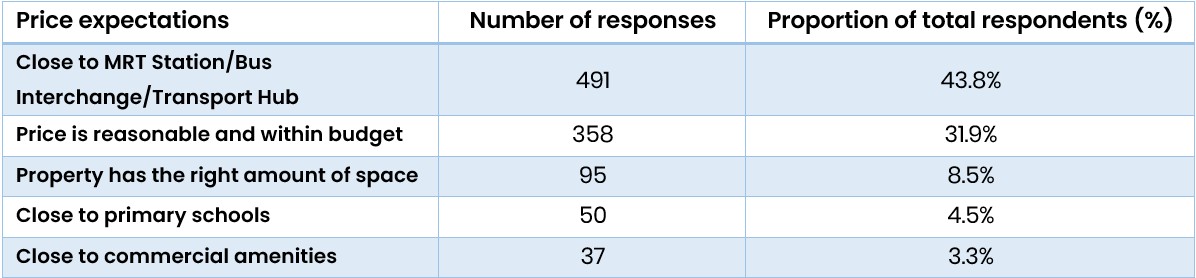

Meanwhile, the two key attributes (see Table 3) that respondents seek when looking for a new home are: proximity to transport nodes (selected by about 44% of those polled); and reasonable pricing (32% of respondents). From PropNex's observations, proximity to the MRT station may be a non-negotiable attribute for many homebuyers today, as the "convenience culture" takes hold. It is little wonder then, that mixed-use/integrated developments, and projects within walking distance to an MRT station - including Parktown Residence in Tampines, The Orie in Braddell, and LyndenWoods in Science Park - have been well-received.

Table 2: Top 5 most preferred locations amongst respondents

Table 3: Top 5 most important attributes of future residences amongst respondents

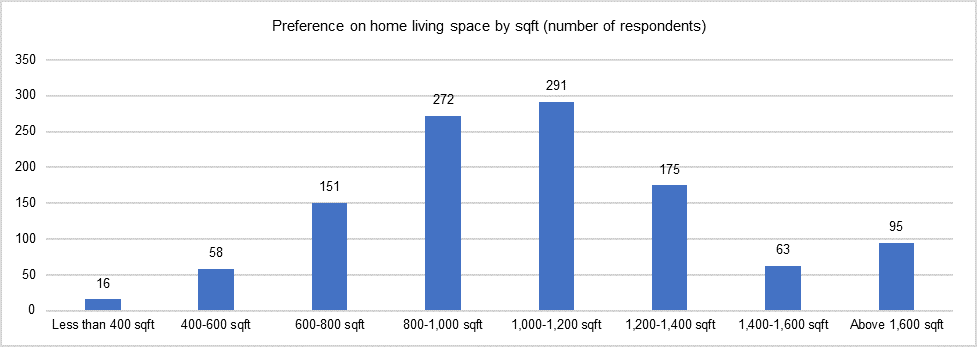

The most preferred unit size range was 1,000 to 1,200 sq ft (see Chart 3), as selected by 291 respondents (or 26%), followed by unit size spanning 800 to 1,000 sq ft which was the choice of 272 respondents (or 24%). This is perhaps not unexpected since more than a quarter of those polled find their current home too small.

By unit type, the three-bedders are cited as the most favoured option by 44.5% of the respondents. This somewhat deviates from actual sales activity at new project launches, since the smaller one- and two-bedroom units tend to sell more quickly - partly owing to their more affordable price quantum compared with larger units.

Chart 3: Preferred unit size among respondents

Units on higher floors often command higher prices as they possess better views of the surroundings, and perhaps provide a more exclusive living experience. The survey found that about half (53.1 per cent) of respondents were willing to pay an additional price premium of $5,000 to $10,000 per additional floor for a unit located at between the 11th and 20th storeys. Meanwhile, 37.3 per cent of those polled were open to paying a price premium of $10,000 to $25,000 per floor for units that are situated above the 20th storey.

It is likely that that buyers who are purchasing a unit for own-stay may be more willing to paying a price premium for a home located on a higher level, as opposed to those buying for investment, who could be more focused on buying a more affordable unit in order to maximise the rental yield.

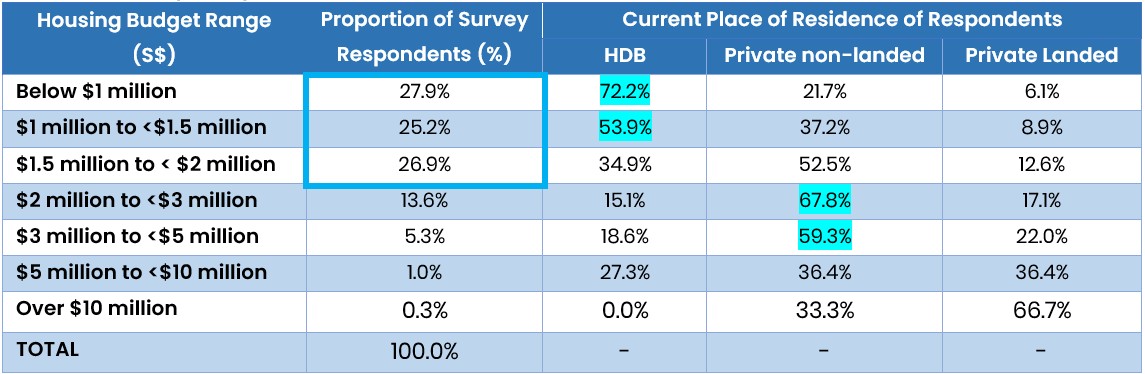

Survey findings showed that buyers are price sensitive, with 80% of the respondents citing a home purchase budget of below $2.0 million (see Table 4), which may potentially limit their options, particularly in the new launch market.

Notably, HDB flat dwellers are more price conscious, with a substantial portion of them citing a budget at below $1.5 million. For instance, 72.2% of those with a budget of under $1 million reside in an HDB flat, while 53.9% of those with a budget of $1 million to below $1.5 million live in public housing.

Meanwhile, respondents who are living in private homes (non-landed or landed) accounted for a greater proportion of those who have a higher housing budget of above $2 million. In particular, those who reside in non-landed private homes made up 67.8% of respondents who cited a budget of $2 million to under $3 million, and 59.3% of those with a budget range of $3 million to below $5 million

Table 4: Housing budget of survey respondents

In the process of buying a new home, prospective buyers have to navigate a tangle of uncertainties and challenges, including concerns about affordability and perhaps a case of "choice paralysis", as they decide between the various housing options before them. Each segment offers different value proposition and buyers may be able to make a more informed decision by working with experienced, knowledgeable and trusted real estate salespersons.

Download the report here for more insights and recommendations for buyers and sellers.